In today’s fast-paced digital economy, customer expectations are higher than ever. They want instant support, personalized advice, and communication in their preferred language. For financial institutions in India, meeting these demands across a linguistically diverse population is a challenge but one that AI-powered chatbots and virtual assistants are solving with remarkable efficiency.

At FinSequr.com, we explore how artificial intelligence is revolutionizing customer service in the financial sector, enhancing satisfaction, trust, and accessibility.

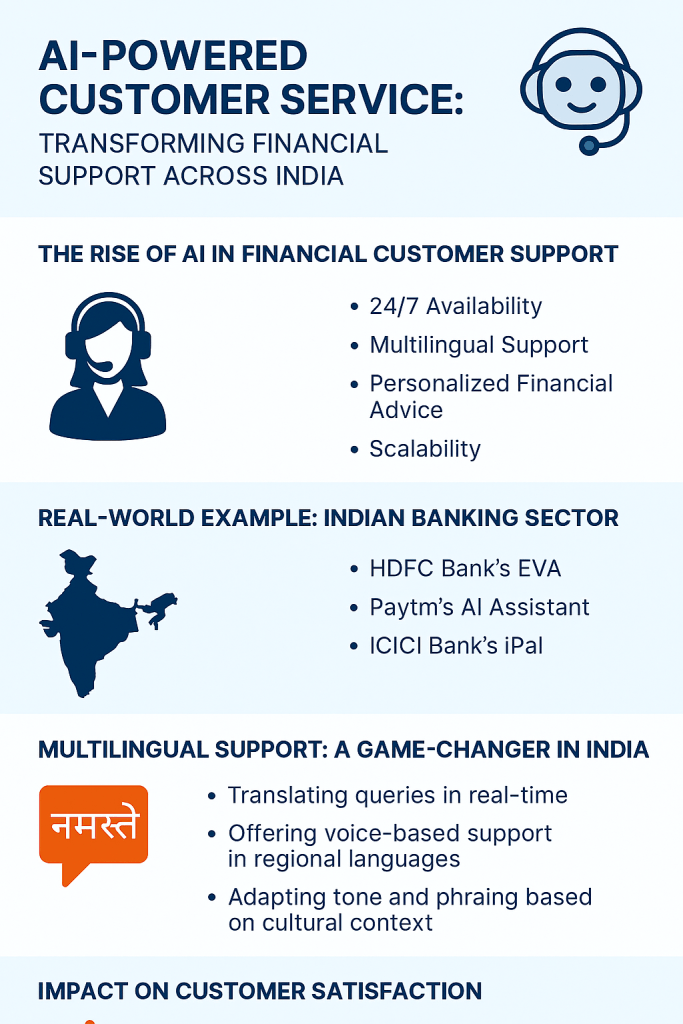

The Rise of AI in Financial Customer Support

AI-powered tools like chatbots and virtual assistants are now integral to customer service strategies. These systems use natural language processing (NLP) and machine learning to understand queries, provide accurate responses, and learn from interactions.

Key Benefits:

- 24/7 Availability

Customers can get help anytime—no waiting for business hours. - Multilingual Support

AI can communicate in Hindi, Marathi, Tamil, Bengali, Kannada, and more, making financial services inclusive. - Personalized Financial Advice

Based on customer data, AI can recommend savings plans, credit options, or investment strategies. - Scalability

Handle thousands of queries simultaneously without compromising quality.

Real-World Example: Indian Banking Sector

Several Indian banks and fintech companies have already adopted AI-powered customer service:

- HDFC Bank’s EVA

One of India’s first AI chatbots, EVA answers millions of queries in English and Hindi, helping customers with account details, loan options, and branch locations. - Paytm’s AI Assistant

Offers multilingual support and personalized financial tips based on user behavior. - ICICI Bank’s iPal

Available 24/7, it helps users with transactions, card services, and investment queries in multiple languages.

How AI Understands and Responds

AI chatbots use:

- Natural Language Understanding (NLU) to interpret user intent.

- Sentiment Analysis to detect frustration or urgency.

- Contextual Memory to maintain conversation flow.

- Secure APIs to fetch real-time financial data safely.

Multilingual Support: A Game-Changer in India

India has 22 official languages and hundreds of dialects. Traditional customer service often struggles to cater to this diversity. AI bridges this gap by:

- Translating queries in real-time.

- Offering voice-based support in regional languages.

- Adapting tone and phrasing based on cultural context.

Example: A customer in Pune can ask a chatbot in Marathi about loan eligibility, while another in Chennai can get investment advice in Tamil—instantly and accurately.

Impact on Customer Satisfaction

- Faster Resolution Times

No hold music or long queues just instant answers. - Higher Engagement

Personalized responses make customers feel valued. - Improved Retention

Happy customers are more likely to stay and recommend services.

Security and Compliance

AI systems in financial services must comply with RBI guidelines on data privacy and cybersecurity. At FinSequr, we ensure that AI tools are:

- Secure – End-to-end encrypted.

- Compliant – Aligned with RBI’s IT and cybersecurity frameworks.

- Auditable – Maintain logs for transparency and accountability.

Final Thoughts

AI-powered customer service is not just a trend it’s the future of financial engagement in India. By offering personalized, multilingual, and round-the-clock support, financial institutions can build stronger relationships, improve operational efficiency, and stay ahead in a competitive market.

At FinSequr, we help organizations integrate secure, compliant, and intelligent AI solutions tailored to India’s unique financial landscape.

Leave a comment